Featured Post

How Much Tax Do You Pay On Crypto Gains Canada

- Dapatkan link

- X

- Aplikasi Lainnya

Lets say you bought a cryptocurrency for 1000 and sold it later for 3000. Determine the adjusted cost base of.

How Much Is The Queen S Net Worth In Cryptocurrency In 2021 Blockchain Cryptocurrency Bitcoin

When you buy new amounts of bitcoin the total ACB is recalculated to be the previous total ACB plus the total cost of the new shares plus any transaction costs.

How much tax do you pay on crypto gains canada. Now this matters as it can make a difference in just how much you should pay in taxes as the calculations are done differently. 50 of the gains are taxable and added to your income for that year. If youre running a business 100 of your crypto-related business income is taxable whereas only 50 of capital gains are taxable.

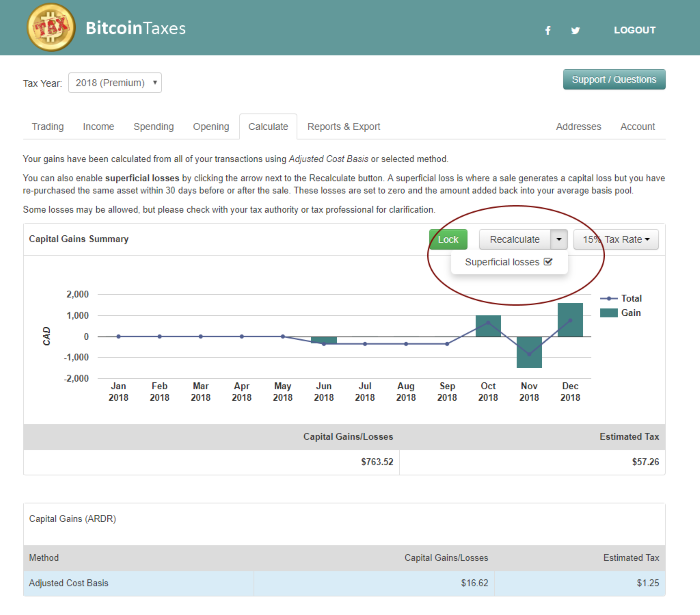

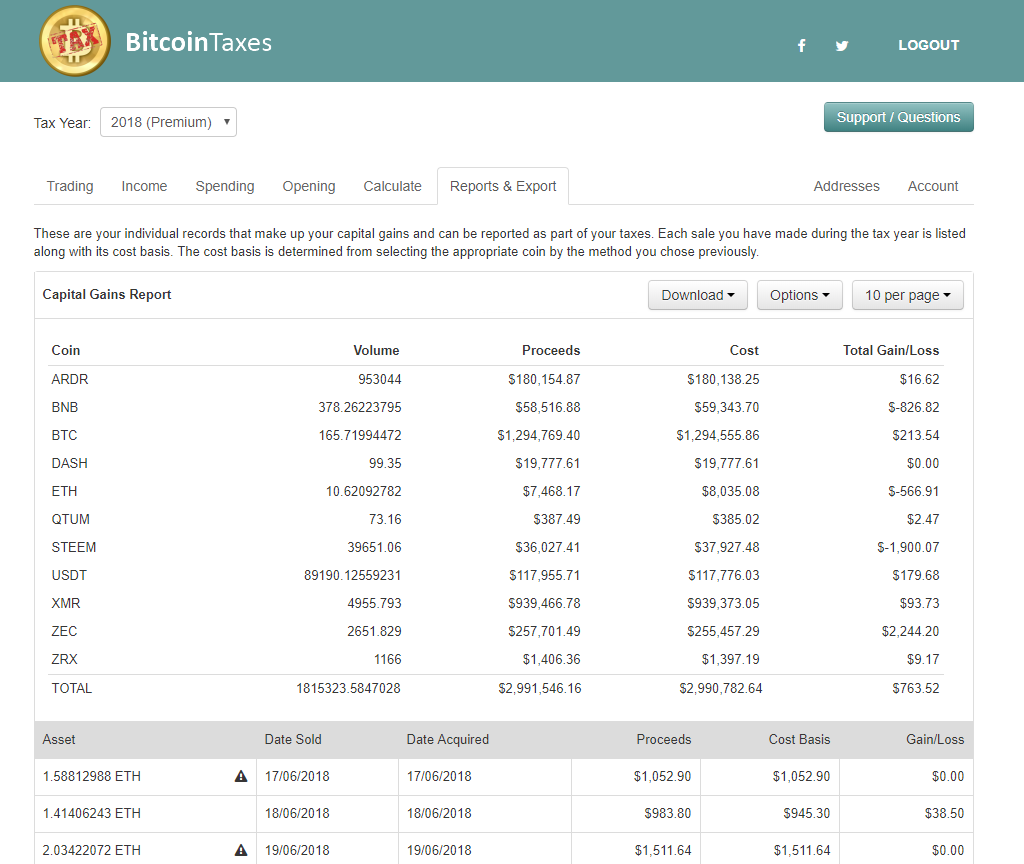

The tax brackets for each province vary so you may be paying different amounts of. To calculate your capital gain or loss follow these steps. When you convert or swap crypto from one to another you will owe taxes on any gains you earn in the transaction.

Remember 50 of your realized capital gains will be taxed at your tax bracket in Canada. Its important to know what the value of the cryptocurrency was in Canadian dollars on the day you purchased it and on the day you sold it in order to understand what amount is subject to capital gains. How is cryptocurrency taxed in Canada.

On the flip side with business income though 100 of it is taxed at your marginal tax rate. With capital gains only 50 of your profits are taxed at your marginal tax rate. 50 of your crypto gains are added to your income and taxed at your marginal tax rate youre only being taxed on your investment gains not the entire value of your crypto holdings.

Capital gains from the sale of cryptocurrency are generally included in income for the year but only half of the capital gain is subject to tax. Cryptocurrency is taxed in Canada as either capital gains or as income tax depending on whether your activity with cryptocurrency is considered to be as a business or not. 100 of business income is taxable whereas only 50 of capital gains are taxable.

In Canada you only pay tax on 50 of any realized capital gains. How is crypto tax calculated in Canada. If your profits from crypto are higher than the Capital Gains Tax allowance you will pay either 10 or 20 on your taxes as of the latest figures.

If you are in the highest income tax bracket your taxes on your long term capital gains will be 20 instead of 37 the highest tax rate for short term gains. You can be liable for both capital gains and income tax depending on the type of cryptocurrency transaction and your invididual circumstances. 100 of business income is taxable whereas only 50 of capital gains are taxable.

Proceeds - ACB GainLoss. If your intraday profits do qualify as capital gains you will need to look to schedule 3. This is called the taxable capital gain.

This totals all the income sources eligible for capital gains and losses. 1500 - 106667 43333 capital gain. If you bought crypto from Netcoins and then transferred to a crypto wallet or another discount brokerage this is not considered to be a taxable event and therefore you do not have to.

You cannot use them to reduce income from other sources such as employment income. 21667 is taxed 50 43333 as capital gains. How substantial the income is.

The capital gains tax rate in Ontario for the highest income bracket is 2676. Cryptocurrency is taxed like any other commodity in Canada. You can use CryptoTraderTax to automatically detect which cryptocurrencies in your portfolio qualify for long term capital gains and to help plan for future trades.

Australia The Australian Tax Office classifies cryptocurrency as a property or a capital gains tax asset. Any capital losses resulting from the sale can only be offset against capital gains. In Canada Crypto is taxed as either capital gains or as income tax depending on whether your activity with cryptocurrency is considered to be as a business or not.

Cryptocurrency is taxed in Canada as either capital gains or as income tax depending on whether your activity with cryptocurrency is considered to be as a business or not. This means that if you earn 2000 in total capital gains then you will pay 53520 in capital gains tax. If you purchased 400 worth of Bitcoin and used it to buy 1000 worth of HBAR youd owe taxes on 600 in realized profit even though youre just.

This means that half of the money you earn from selling an asset is taxed and the other half is yours to keep tax-free. This comes with a distinct advantage capital gains are taxed at just 50 of your marginal tax rate. For example you might need to pay capital gains on profits from buying and selling cryptocurrency or pay income tax on interest earned when holding crypto.

New Canadian Regulations On Crypto And Virtual Currency Exchanges Cryptocurrency Virtual Currency Financial Advisors

Cryptocurrency Taxes In Canada Cointracker

Paypal Absent From Libra Association Meeting Might Abandon Project Entirely Cryptocurrency Bitcoin Blockchain Technology

Canada S Tax Authority The Canadian Revenue Agency Cra Has Been Trying To Seek Out The Country For Anyone Who May Have Made Gains F Canada Gemini How To Get

Canadian Cryptocurrency Tax Reporting For Exchanges And Users Taxbit Blog

The Tech Royalty Retirement Plan In 2021 Retirement Planning How To Plan Investment Advice

Guide To Bitcoin Crypto Taxes In Canada Updated 2020

Best Ethereum Ira Companies Bitcoin Investing Ideas Of Bitcoin Investing Bitcoin Investing Bitcoininvesting In 2020 Investing Investment Quotes Investing Money

Pin On Bill S Board Of Random Topics

Cryptocurrency Taxes In Canada The 2021 Guide Koinly

Free Crypto Tax Calculator How To Calculate Cryptocurrency Taxes Zenledger

How Crypto Volatility Drives The Cryptocurrency Market Cryptocurrency Cryptocurrency Trading Blockchain Technology

Pin On All About Crypto Currency

- Dapatkan link

- X

- Aplikasi Lainnya

Komentar

Posting Komentar