Featured Post

How To Determine Intrinsic Value Of An Option

- Dapatkan link

- X

- Aplikasi Lainnya

You simply take the difference between the stocks current price and the options strike price then multiply by the number of shares your options entitle you to buy. The stock options exercise price or strike price is 30 per share.

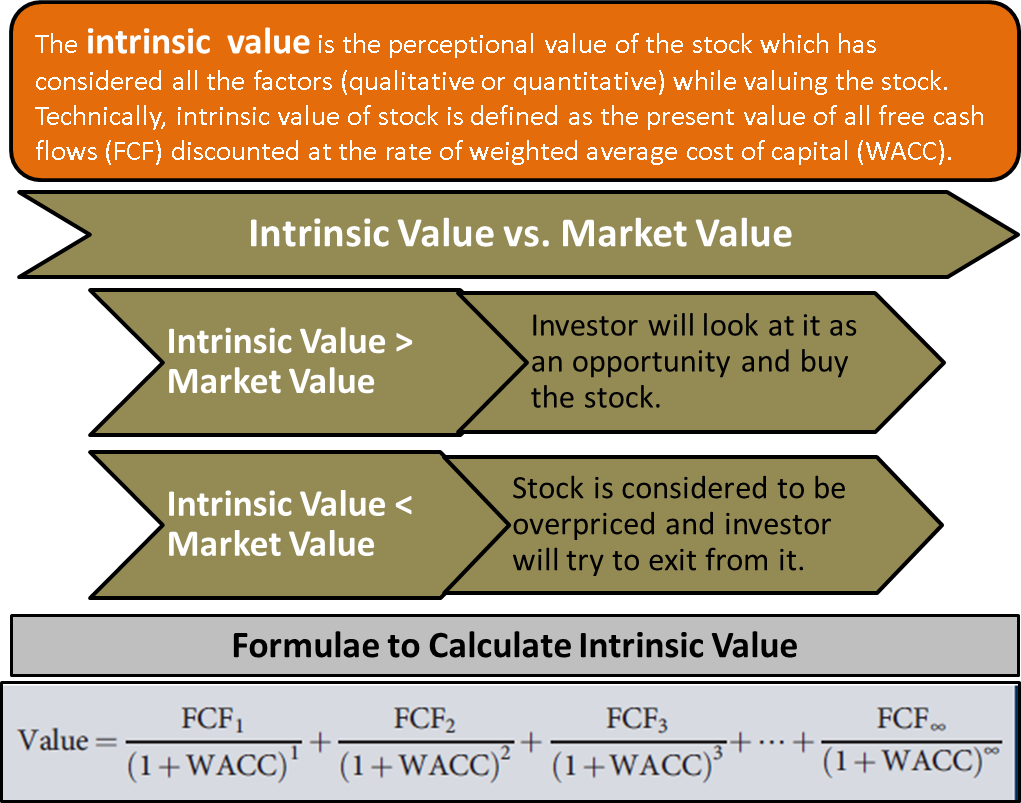

Intrinsic Value Define Calculate Formula Vs Market Value Book Value

Look at the formula below.

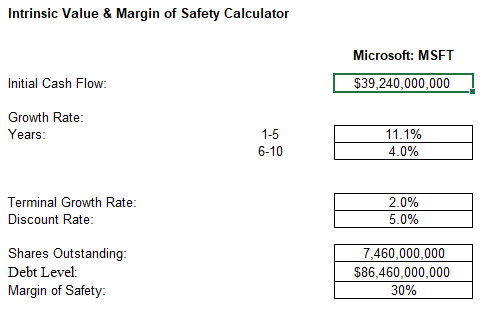

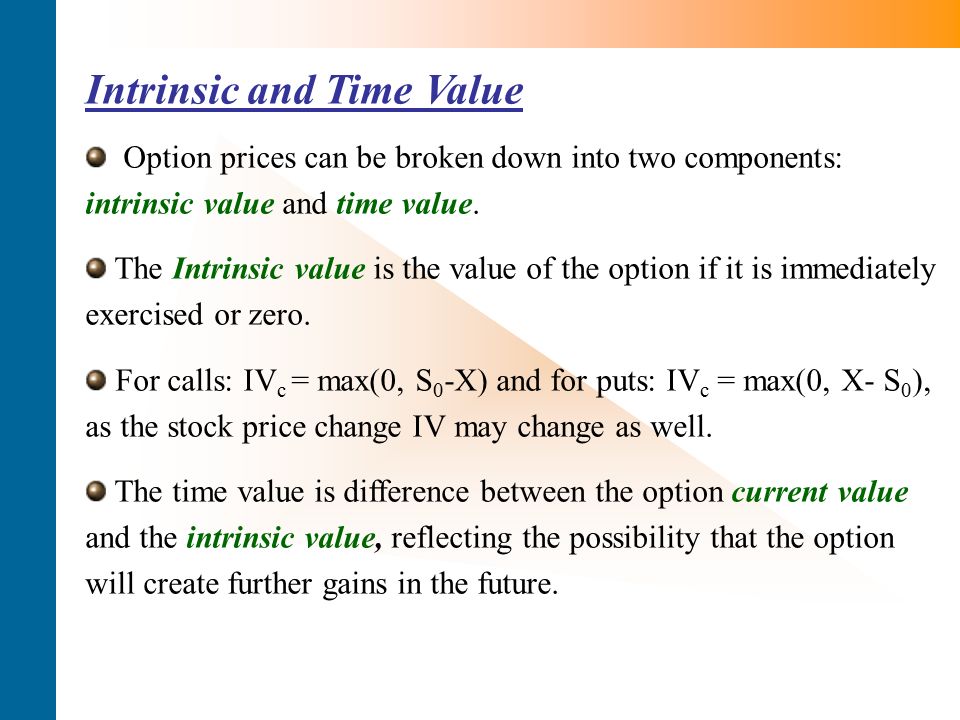

How to determine intrinsic value of an option. Premium Time Value Intrinsic ValueIntrinsic Value CALL Max 0 Spot - Strike Intrinsic Value PUT Max 0 Strike - Spot Time Value is maxim. When the strike price of a call option is lower than the market price the option is said to be in the. For an in-the- money put option the intrinsic value equals the stock options strike price minus the price of the underlying stock.

Strike 950 Value 942 - 950 0. You own four call options that entitle you to buy 100 shares per call. The intrinsic value of each stock option is 20 50 common stock market price minus 30 exercise price equals 20 intrinsic value.

For Call option. Intrinsic Value Put Option. Calculating intrinsic value is easy.

Intrinsic value Strike Price - Current price of underlying. Call Option Intrinsic Value Stock Price Strike Price. Strike 900 Value 942 - 900 42.

If the market price is below the strike price then the put option has a positive intrinsic value. If value is a negative number then its considered zero. Intrinsic value Call Strike Price - Underlying Stocks Current Price.

Value SPOT - STRIKE. If the above value is positive then the option is In the money. The company grants a key employee 10000 stock options to purchase shares of the companys common stock.

Intrinsic value Stock price-option strike price x Number of options Suppose a given stock trades for 35 per share. Hence your intrinsic value calculator. On the date of grant the market price of the common stock is 50 per share.

If the market price is above the strike price then the put option has zero intrinsic value. If the option is at-the- money or out-of-the- money the intrinsic value is always zero. If it is negative then the option is out of the money and if it zero it is at the money.

Intrinsic value in context of option trading is the amount by which the strike price of an option is in the money. Call Option Intrinsic Value Current Stock Price Call Strike Price. For example you hold a Reliance Call Option at 900 and the current price of the stock is 920 then the intrinsic value.

How to Calculate the Intrinsic Value Time Value of a Call Option Description. In our example consider the following STRIKE prices. Intrinsic value Current price of underlying - Strike Price.

Finding Intrinsic value of a CALL option formula. The intrinsic value of a call option is the difference between the strike price and.

/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

Option Pricing Models Formula Calculation

How To Calculate Time Value Intrinsic Value Premium Of An Option Youtube

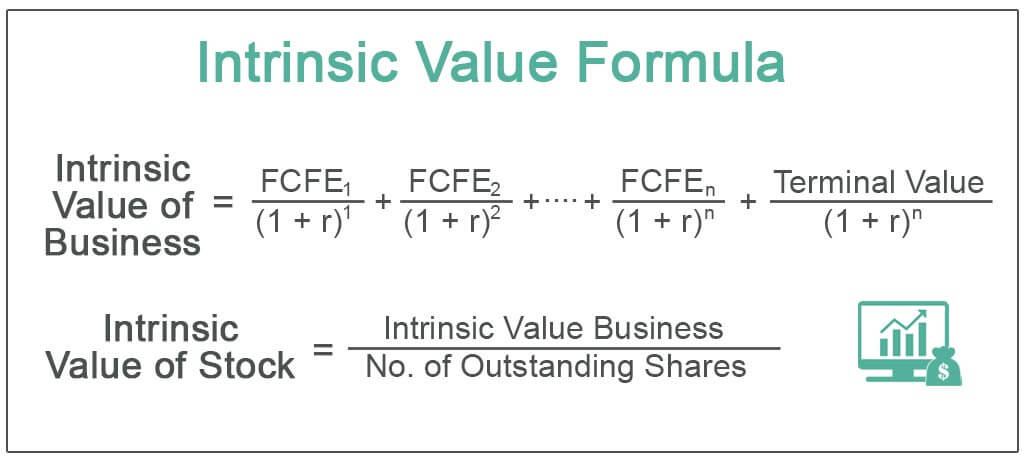

How To Calculate Intrinsic Value Of A Stock Excel

/TheImportanceofTimeValueinOptionsTrading1_3-ad26c7e621bb4a19ae4549e833aab296.png)

The Importance Of Time Value In Options Trading

The Ultimate Guide To Option Moneyness Itm Otm Atm

What Is The Intrinsic Value Formula Try This Online Calculator Ben Graham Getmoneyrich

How To Calculate Time Value Intrinsic Value Premium Of An Option Youtube

/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

Option Pricing Models Formula Calculation

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-02-ba51015e895b4ba7abbd7632e1908360.jpg)

Option Pricing Models Formula Calculation

Extrinsic Value Of An Option Definition Examples How It Works

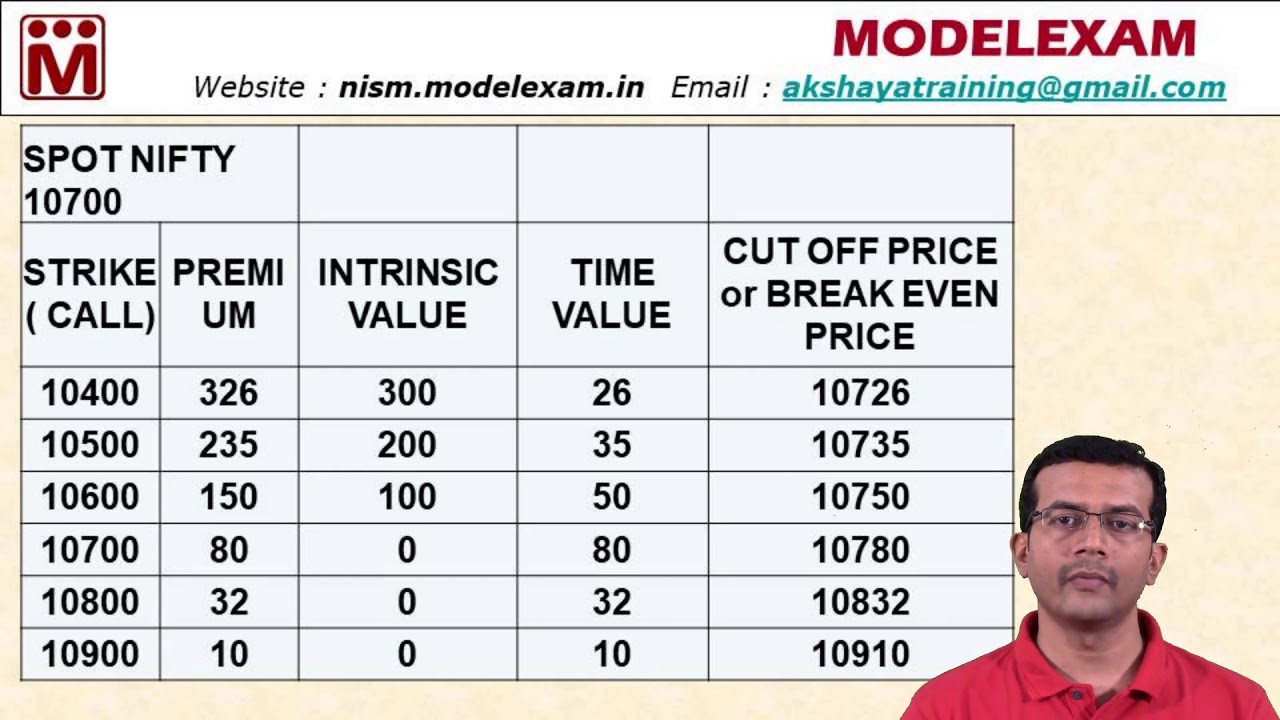

Intrinsic Value Formula Example How To Calculate Intrinsic Value

Extrinsic Value By Optiontradingpedia Com

What Is The Intrinsic Value Formula Try This Online Calculator Ben Graham Getmoneyrich

Which Stocks Have The Highest Option Premium Power Cycle Trading

The Options Industry Council Oic Options Pricing

What Is Intrinsic Value Youtube

Introduction To Options Option Definition An Option Is A Contract That Gives The Holder The Right But Not The Obligation To Buy Or Sell A Defined Asset Ppt Download

/dotdash_Final_Extrinsic_Value_Curve_Apr_2020-01-010f32375f534dd78b2b8af044b8e65d.jpg)

Komentar

Posting Komentar